Some Known Facts About Matthew J. Previte Cpa Pc.

Table of ContentsGetting The Matthew J. Previte Cpa Pc To WorkWhat Does Matthew J. Previte Cpa Pc Mean?Getting My Matthew J. Previte Cpa Pc To WorkThe Only Guide to Matthew J. Previte Cpa PcSome Known Factual Statements About Matthew J. Previte Cpa Pc How Matthew J. Previte Cpa Pc can Save You Time, Stress, and Money.

Tax obligation laws and codes, whether at the state or federal degree, are too made complex for most laypeople and they change too frequently for numerous tax experts to stay on par with. Whether you just require a person to aid you with your organization revenue tax obligations or you have actually been charged with tax fraud, hire a tax lawyer to aid you out.

Matthew J. Previte Cpa Pc Can Be Fun For Everyone

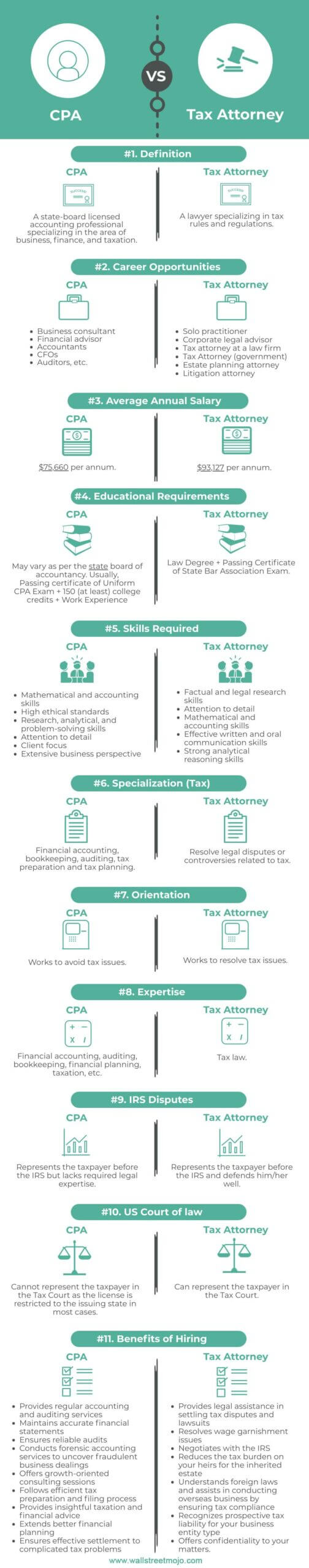

Every person else not only disapproval dealing with taxes, however they can be outright worried of the tax agencies, not without reason. There are a few inquiries that are always on the minds of those that are managing tax problems, including whether to hire a tax lawyer or a CERTIFIED PUBLIC ACCOUNTANT, when to hire a tax obligation attorney, and We really hope to help respond to those questions below, so you know what to do if you locate yourself in a "taxing" scenario.

A lawyer can stand for customers prior to the IRS for audits, collections and appeals but so can a CPA. The huge difference right here and one you need to maintain in mind is that a tax attorney can supply attorney-client advantage, suggesting your tax obligation lawyer is exempt from being obliged to affirm against you in a court of legislation.

The Ultimate Guide To Matthew J. Previte Cpa Pc

Or else, a certified public accountant can affirm against you also while functioning for you. Tax attorneys are more knowledgeable about the different tax negotiation programs than a lot of CPAs and recognize exactly how to choose the best program for your situation and just how to obtain you gotten that program. If you are having a trouble with the IRS or just questions and concerns, you need to hire a tax attorney.

Tax Court Are under examination for tax fraud or tax obligation evasion Are under criminal investigation by the internal revenue service Another vital time to employ a tax obligation attorney is when you obtain an audit notice from the internal revenue service - tax lawyer in Framingham, Massachusetts. https://www.giantbomb.com/profile/taxproblemsrus1/. A lawyer can interact with the IRS in your place, be existing during audits, assistance discuss negotiations, and maintain you from overpaying as an outcome of the audit

Component of a tax lawyer's task is to keep up with it, so you are shielded. Ask around for a seasoned tax lawyer and inspect the internet for client/customer evaluations.

7 Simple Techniques For Matthew J. Previte Cpa Pc

The tax obligation lawyer you have in mind has every one of the appropriate qualifications and endorsements. Every one of your concerns have actually been answered. tax lawyer in Framingham, Massachusetts. Should you hire this tax attorney? If you can pay for the costs, can these details agree to the type of potential service provided, and have self-confidence in the tax attorney's ability to aid you, after that indeed.

The decision to hire an IRS lawyer is one that need to not be taken lightly. Lawyers can be extremely cost-prohibitive and complicate matters unnecessarily when they can be settled reasonably conveniently. In general, I am a big advocate of self-help lawful options, specifically offered the selection of educational product that can be located online (consisting of much of what I have published on taxes).

7 Simple Techniques For Matthew J. Previte Cpa Pc

Below is a fast checklist of the issues that I believe that an Internal revenue service attorney need to be hired for. Bad guy costs and criminal examinations can destroy lives and bring extremely significant consequences.

Lawbreaker costs can also carry added civil fines (well past what is common for civil tax matters). These are just some instances of the damage that also simply a criminal charge can bring (whether or not an effective sentence is inevitably obtained). My point is that when anything potentially criminal occurs, even if you are just a possible witness to the issue, you require a seasoned IRS attorney to represent your interests against the prosecuting company.

Some may cut short of nothing to acquire a conviction. This is one instance where you always need an IRS attorney viewing your back. There are numerous parts of an IRS attorney's job that are seemingly routine. Most collection issues are dealt with in approximately the exact same method (although each taxpayer's situations and goals are different).

9 Easy Facts About Matthew J. Previte Cpa Pc Explained

Where we earn our red stripes however gets on technical tax matters, which placed our complete ability to the test. What is a technological tax concern? That is a challenging question to respond to, but the very best way I would explain it are issues that need the specialist judgment of an IRS lawyer to resolve effectively.

Anything that possesses this "reality reliance" as I would certainly call it, you are going to wish to generate an attorney to talk to - tax attorney in Framingham, Massachusetts. Even if you do not preserve the services of that attorney, a skilled perspective when handling technological tax obligation issues can go a long method towards recognizing issues and solving them in an appropriate manner